Fintech meets Telecom CELTIC Proposers Day in Luxemburg

Marc Ferring from Luxinnovation opening the Celtic-Plus Proposers Day.

On 13 December 2017, Celtic-Plus, local funding agency Luxinnovation and the Luxemburg House of Financial Technology (LHoFT) organized a Celtic-Plus proposers day on “Fintech meets Telecom” at the Chambre de Commerce in Luxembourg. The aim of this Proposer Day was to initiate collaboration between the Celtic-Plus community, telecoms operators, fintech companies and banks, which will lead to successful Celtic-Plus projects. Accordingly, project ideas on communication-related subjects have been presented.

Valerie Blavette from Orange welcoming the attendees to the Celtic-Plus Proposers Day.

The Proposers Day was opened by Marc Ferring, Director of the local funding Agency Luxinnovation, and by Valerie Blavette, Celtic-Plus Vice-Chair from Orange. They welcomed the participants, and Valerie underlined the benefits of combining the Celtic Research Domains with fintech.

Alessa Bonanno from BTO Research

Peter Herrmann the Celtic-Plus Director introduced the keynote speakers Alessia Bonanno, Country Manager at BTO Research, and Stefano Rossi, Blockchain Business Board also from BTO Research, on the topic “fintech meets Telecom”. Alessia Bonanno underlined the focus of BTO on supporting the digital transformation including the impact of blockchain technology on telecommunications and media industries.

Stefano Rossi from BTO Research

The blockchain specialist Stefano Rossi started with an introduction on disruptive technologies in ICT, referring to Spotify, Netflix and Bitcoin. He highlighted the importance of understanding the need of quickly adapting to new technologies to ensure a place in the future ICT market, as Google, Amazon and Facebook have already done. With the beginning of the rise of smart contracts, which facilitate digitally verification and enforcement of the negotiation of a contract, about one billion dollars have been invested in blockchain technologies in the last years. The Distributed Ledger Technology (advanced blockchain) is mostly used for enterprise clients to share cryptographic databases that are managed by trusted intermediaries focusing on explorations of E-SIM and M2M micropayment possibilities as used by Orange, BT, and AT&T. McKinsey Global Institute reports in ‘The Internet of Things: Mapping the value beyond the Hype’ that linking physical and digital worlds could add $11.tr in economic value by 2025.

Kari Inberg Senior Adviser for SMEs from Business Finland

The telco business has changed a lot in the last years

Kari Inberg Senior Adviser (SMEs) from Business Finland (former TEKES) said that the telco business has changed a lot in the last years and that communication technologies and fintech could do the same in the near future. Legislation and regulation will be key in big data related business.

Alexander Link from Luxinnovation

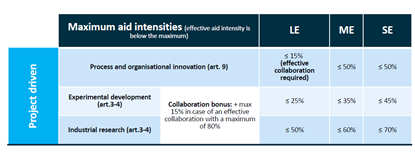

Relevant Aid Schemes for Celtic-PlusProjects

Alexander Link from Luxinnovation showed insights on funding possibilities in Luxemburg. He explained the different funding conditions for research projects and for closer to the market development for small and large industry.

Panel on telecoms operators in the Fintech value chain

From Left to right: Andrey Martovoy, fintech Adviser at ABBL (Luxembourg Bankers’ Association), Chris Marcilla, Chief Compliance Officer, CryptoAsset Specialist, Chairman@ Virtual Currencies, Randy Zadra NRC, Canada (Panel Moderator), Keith Hale, Chairman ALFi Blockchain & Cryptocurency group and CEO of Multifonds/ IGEFI Group Sàrl, Luxembourg and Namir Anani, CEO, Information and Communications Technology Council of Canada.

A central point of the panel’s discussion was the licensing approach to enable fintechs to use banking services via the Standard from the Open Banking Working Group (OBWG). The Open Banking Standard relies on data being securely shared through open APIs that would let third party apps, such as fintech companies, access users’ data through their bank accounts. The Open Banking Standard would launch a new wave of banking innovation for users, developers, and banks. The panel discussed how to gain new business opportunities for telecom operators by using blockchain as a backbone in future 5G technologies.

Project proposal pitches

Another core element of the Proposers Day was the pitching of project ideas. The presentations were followed by productive discussions with the audience. Some of these discussions could lead to interesting new Celtic-Plus project proposals.